Gold mining stocks have been climbing since the end of December, a trend that usually goes unnoticed unless gold — often dismissed as an “old relic” — undergoes one of its periodic shifts into a timely and relevant asset.

Gold mining stocks have been climbing since the end of December, a trend that usually goes unnoticed unless gold — often dismissed as an “old relic” — undergoes one of its periodic shifts into a timely and relevant asset.

Recently, gold has been in the public spotlight, shedding its “relic” skin to reveal itself, once again, as a safe haven asset. If you haven’t been following the yellow metal, here’s what you might have missed:

- Gold prices have been rising, making mining a profitable venture.

- Central banks worldwide have ramped up gold purchases, driving prices higher.

- Several mining mergers have taken place, improving efficiency.

- Safe-haven demand, driven by geopolitical and economic uncertainties, has fueled gold investment.

- Gold mining can also mean silver extraction (along with other metals), which is in short supply.

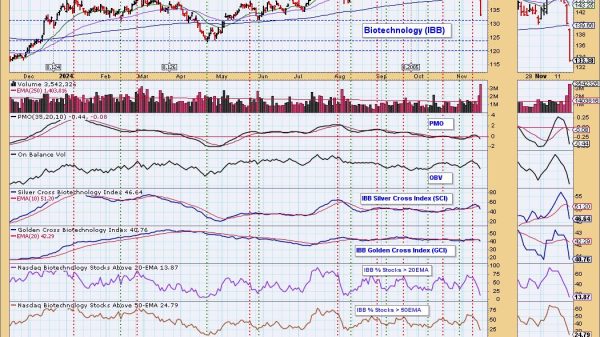

A glance at the5-day MarketCarpets’ Bullish Percent Index (BPI) view on Thursday shows that next to healthcare, gold miners have the second largest lead over other indices and sectors.

FIGURE 1. MARKETCARPERTS BPI CHART. Gold miners have the second-highest BPI reading among other sectors and indices.Image source: StockCharts.com. For educational purposes.

This 5-day BPI reading tells you that over 41% of gold mining stocks exhibit Point & Figure buy signals. This suggests a surge in buying activity relative to the other sectors on the list.

As StockCharts’ PerfCharts below show, rising gold and silver prices have been fueling gold mining activity and investment (note that this isn’t always the case, as various operational factors can impact mining companies independently of the metal prices they produce). We’ll use the VanEck Vectors Gold Miners ETF (GDX) as our industry proxy.

FIGURE 2. PERFCHARTS OF GDX,GLD, AND SLV. The metals are leading miners and driving mining activity and investment.Image source: StockCharts.com. For educational purposes.

Taking a look at GDX’s weekly chart, you can see the relative performance between gold mining stocks and the yellow metal.

FIGURE 3. WEEKLY 5-YEAR CHART OF GOLD MINERS. Note how gold prices are now leading the collective performance of the gold mining industry.Image source: StockCharts.com. For educational purposes.

For years, gold mining stocks led the price of gold (represented by the blue line), but, over the past year, gold has begun outperforming miners. This suggests a few possibilities:

- Investors might have been concerned about rising operational costs and weaker profit margins in the mining sector, favoring gold over the companies that produce it.

- Now, the renewed interest in mining stocks suggests that investors might be anticipating improved profitability in miners as gold prices continue to rise.

But is investing in miners a wise move or a trap? As the daily chart below shows, it can be either. It all depends on how the index reacts at critical technical levels.

FIGURE 4. DAILY CHART OF GDX. Keep a close eye on resistance at $38 and support at $33.Image source: StockCharts.com. For educational purposes.

GDX has pulled back from its high of $43.71. Is this a pullback or the beginning of a more significant trend reversal Whether the rally continues or reverses into a downtrend depends on whether the price breaks above resistance at $38 or falls below support at $33.

This notion rests on the simple principle that an uptrend consists of consecutive higher highs and lows and that a downtrend consists of consecutive lower lows and highs. The ZigZag line effectively highlights this trend movement, especially the current swing high ($38) and low ($30).

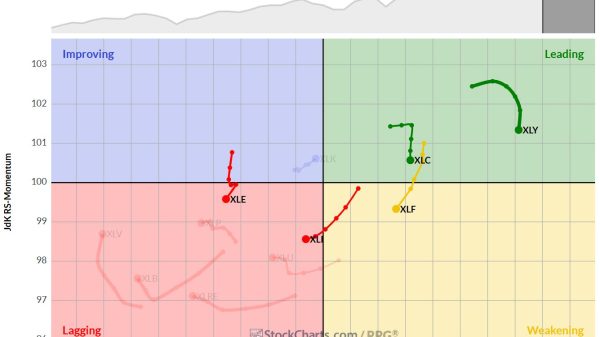

In terms of technical strength, volume, and momentum:

- The StockCharts Technical Rank (SCTR) line is rising but still below the initial bullish threshold of 76. This is a promising indication, but not yet confirmed bullish.

- Buying pressure, according to the Chaikin Money Flow (CMF), is above the zero line, indicating buyers are starting to take control of the market.

- The Relative Strength Index (RSI) is rising yet below the 70 threshold, indicating there’s still room for GDX to run before entering overbought territory.

The main point is to add GDX to your ChartLists, watch how it responds to the key support and resistance levels, and monitor volume and momentum readings for confirmation.

At the Close

Gold mining stocks have gained momentum alongside rising gold prices. While this signals renewed interest in the industry, the technicals, in this case, can give you a much clearer picture of the underlying dynamics of price and market sentiment. Keep an eye on those levels to help you make a sound decision and pinpoint optimal timing.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.