In September, the Fed cut the target range for its policy rate by 50 basis points to much publicity, with several media outlets claiming that this was the first step toward reducing borrowing costs and easing the debt burdens faced by many Americans. Of course, the implicit assumption is that economy-wide borrowing rates such as auto loans, credit cards, or mortgages are intrinsically linked to the Fed’s policy instrument—the federal funds rate (FFR). It may come as a surprise, then, that several borrowing rates, ranging from treasury securities to mortgage rates, have increased since the Fed’s rate cut.

In fact, the discrepancy between the FFR and other borrowing rates has been prevalent for some time. The rates had started to increase before the series of rate hikes executed by the Fed in response to post-pandemic inflation. On the surface, it is fair to assume that changes to the FFR should be transmitted through to other borrowing rates. After all, the FFR is believed to represent the cost borne by financial institutions to acquire liquid reserves for themselves in the interbank lending market. If the cost to acquire funds is low, then the cost of lending these funds to consumers must be equivalently low. However, since the overhaul of the Fed’s operating procedures in the aftermath of the financial crisis, the FFR no longer holds sway as it once did.

Following the financial crisis of 2008-09 and its associated recession, the Fed shifted to a “floor system” that would ensure abundant reserves in the financial sector. That is, it instituted policies such as interest on excess reserves and quantitative easing that ensured banks would maintain a large surplus of reserves, reducing their need to engage in interbank lending and thereby reducing the importance of the FFR. Of course, the FFR still matters as a numeric stance of monetary policy, but it is hard to see how it can hold any importance beyond this signaling effect.

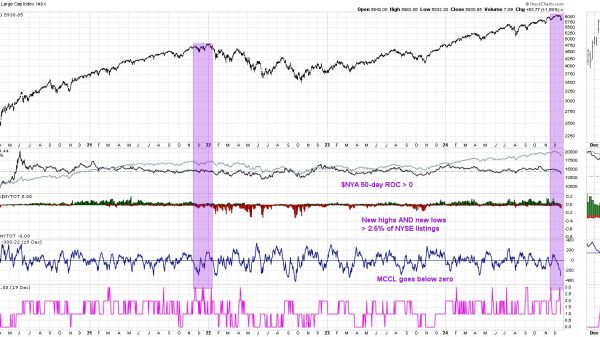

Data on borrowing costs confirm this hypothesis. Figures 1–3 show the correlation between monthly FFR and three other key borrowing rates. These include the 30-year mortgage rate (Figure 1), Moody’s Baa corporate bond yield (Figure 2), and the 10-year Treasury yield (Figure 3)—which represent benchmarks for consumer, corporate, and government debt, respectively. Additionally, correlations were computed for various lag structures so that any leading or lagging effects between the FFR and other borrowing rates may be observed. This analysis was conducted over two periods—the Great Moderation (1984 through 2006) and the post–financial crisis (2009 to present)—to see how the post-2008 change to the Fed’s operating system affected these correlations.

As all figures show, before the financial crisis, the FFR was linked almost perfectly (i.e., a near 100 percent correlation) with other borrowing costs. Within the same month, changes to the FFR were matched by near identical changes to other borrowing costs. This is no longer true following the financial crisis. Under the Fed’s revised framework, the same-month correlations fall drastically. FFR correlation with the 30-year mortgage rate falls to 70 percent, with Baa bond yield falling to 58 percent, and with the 10-year Treasury yield falling to 71 percent.

Additionally, the skew of the cross-correlation distribution has changed since the financial crisis. Before 2007, the correlation distribution was symmetrical around a zero lag. That is, changes to the FFR and other borrowing rates occurred simultaneously with neither being a leading nor lagging indicator of the other. However, under the post-crisis regime, the distribution shows a significant left skew. This implies that the FFR is much more likely to be correlated with other borrowing rates at a lag and much less likely at a lead. Put differently, the results suggest that other borrowing costs move first (probably in response to economic conditions) and are then followed by movements to the FFR.

Naturally, the FFR is still correlated with other rates even though this correlation has fallen significantly over time. This is because all borrowing rates respond to general economic conditions that may warrant tighter or looser lending conditions. However, the results presented here indicate that the mechanism by which this transmission occurs from the broader economy to relevant borrowing costs seems to bypass the Federal Reserve. If anything, the Fed seems to take its cue from the markets, not the other way around.

This analysis only adds to the litany of evidence we have presented that the Fed matters much less than people think. Of course, some may claim that the Fed is still a primary determinant of lending conditions but that how it controls such markets has changed. If that is true, then the onus is on the Fed to provide a detailed explanation of which policy instrument now matters instead of the FFR and the mechanism by which this instrument affects lending standards and, thereby, its dual mandate objectives of low inflation and stable employment. So far, it has not provided any such explanations.

The author thanks Jerome Famularo for his excellent research assistance in the preparation of this blog.