Good morning, and welcome to this week’s Flight Path.

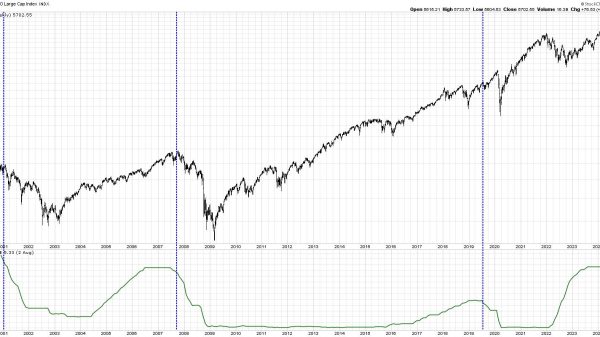

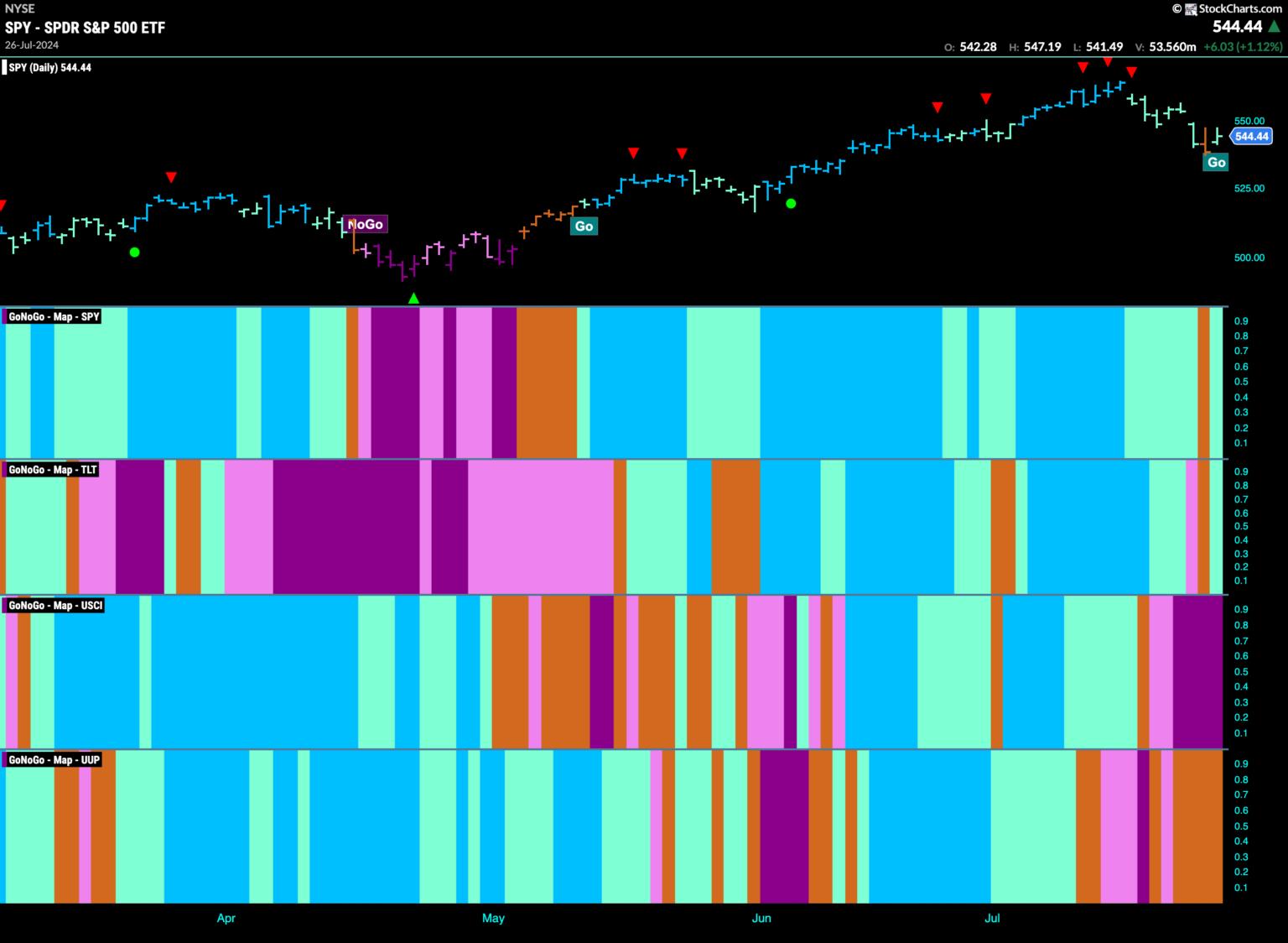

Equities had another tough week last week, and we saw an amber “Go Fish” bar for the first time since this latest “Go” trend began. Encouragingly, GoNoGo Trend painted a weak aqua “Go” bar on the last day of the week, but has the damage been done? Treasury bond prices also fell briefly out of the “Go” trend but also ended the week with an aqua “Go” bar. US commodities fell deeper into a “NoGo” as the indicator painted a strong purple bar. The dollar still cannot make up its mind, and we saw a string of “Go Fish” this past week.

SPY Manages To Maintain a “Go” for Now

Price has fallen further since the Go Countertrend Correction Icons that we saw at the top. This week, a “Go Fish” bar was painted as the market expressed its uncertainty. This comes as GoNoGo Oscillator crashed through the zero line into positive territory on heavy volume. We know that in a healthy trend, the oscillator should find support at that level, and so we know now that momentum is out of step with the “Go” trend. We will be wary of more price deterioration here.

A Hint of Weakness on the SPY Weekly Chart

For the first time in almost three months, SPY did not close in a strong blue bar. We also note the Go Countertrend Correction Icon (red arrow) that appeared at the top. This suggests that price may struggle to move higher in the short term because momentum has waned. We will see if the oscillator finds support at zero as it gets closer.

Treasury Rates in “NoGo” but Paint Weak Pink Bars

This week, we saw a week of uninterrupted pink “NoGo” bars. Price seems to have set a new lower high as we ended the week lower. If we turn our eye to the GoNoGo Oscillator we can see that it is testing the zero line from below. If this NoGo trend is to remain in place we expect to see this level act as resistance. If GoNoGo Oscillator is turned away into negative territory we will look for price to make an attempt at new lows.

Continued Uncertainty for the US Dollar

We’ve been discussing uncertainty in the US dollar for a few weeks now. This week, we saw “Go Fish” bars dominate as price moved mostly sideways. The GoNoGo Oscillator is riding the zero line after rising to it from below. We see a GoNoGo Squeeze climbing to its Max. We will pay close attention to the direction of the break. If the oscillator breaks back into negative territory, then we will look for price to move lower.